What Is Forex Trading In South Africa

Reviewed by Nick Cawley on Dec 20, 2021

Forex Trading: What is Forex?

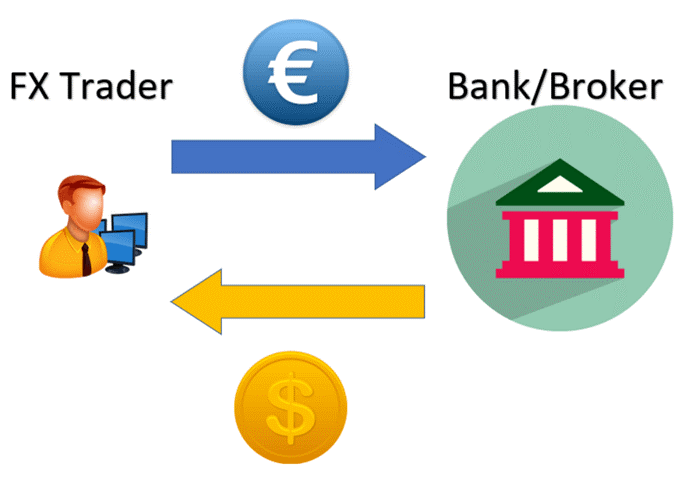

Forex trading is a term used to describe individuals that are engaged in the active exchange of strange currencies, often for the purpose of financial do good or gain. That can take on the class of speculators, who are looking to purchase or sell a currency with the goal of profiting from the currency's price motion; or information technology tin can be a hedger that's looking to protect their accounts in the result of an adverse move against their own currency positions.

The term 'forex trader' may describe an individual trader on a retail platform, a bank trader utilizing their institutional platform, or hedgers who may be either managing their own risk or outsourcing that role to a bank or money director to manage the chance for them.

Forex Trading: The FX Market

The foreign commutation market, or forex (FX) for curt, is a decentralized market place that facilitates the buying and selling of different currencies. This takes place over the counter (OTC) instead of on a centralized exchange.

Without knowing it, y'all have probably already participated in the foreign substitution market by ordering imported products such as clothing or shoes, or more obviously, buying foreign currency when on vacation. Traders may be drawn to forex for several reasons, including:

- The size of the FX market

- A wide diversity of currencies to trade

- Differing levels of volatility

- Low transaction costs

- 24 hours a twenty-four hours trading during the calendar week

This article will address traders of all levels. Whether y'all are make new to forex trading or looking to build on your existing knowledge, this commodity seeks to provide a solid foundation to the strange exchange market place.

Forex Trading: Two Sides to Every Market

I unique aspect of the Forex marketplace is the manner in which prices are quoted. Because currencies are the base of the fiscal system, the only way to quote a currency is past using other currencies. This creates a relative valuation metric that may sound disruptive at first, but can become more normalized the longer that 1 works with this 2-sided convention.

Forex trading in a pair does offer the trader a chip of additional flexibility, by allowing the trader or investor the ability to voice their trade confronting the currency that they feel most appropriate.

Let's take the Euro for example, and let'southward say a trader has optimistic projections for the European economic system and would thusly similar to go long the currency. But – allow's say this investor is also bullish for the US economy, merely is surly for the UK economy. Well, in this case, the investor isn't forced to buy the Euro against the The states Dollar (which would be a long EUR/USD merchandise); and they can, instead, purchase the Euro against the British Pound (going long EUR/GBP).

This affords the investor or trader that extra chip of flexibility, allowing them to avert 'going curt' the Usa Dollar to purchase the Euro and, instead, allowing them to buy the Euro while going short the British Pound.

Forex Trading: Base v/s Counter Currencies

1 important distinction of a Forex quote is the convention: The first currency listed in the quote is known as the 'base' currency of the pair, and this is the nugget that's being quoted. The second currency in the pair is known as the 'counter' currency, and this is the convention of the quote, or the currency that's being used to define the value of the first currency in the pair.

Permit'southward have EUR/USD as an example…

The Euro is the first currency in the quote, so the Euro would be the base currency in the EUR/USD currency pair.

The The states Dollar is the second currency in the quote, and this is the currency that the EUR/USD quote is using to define the value of the Euro.

So, permit's say that the EUR/USD quote is ane.3000. That would mean that ane Euro is worth $i.30. If the cost moves upward to $1.35 – so the Euro would have increased in value and, on a relative ground, the US Dollar would've decreased in value.

If an investor was surly the Euro simply bullish on the US Dollar, they could choose to 'short' the pair, expecting prices to autumn; later on which they could 'cover' the trade by buying it back at a lower price, and pocketing the departure.

Forex Trading: The Forex Market place Explained

In a nutshell, the foreign commutation marketplace works like many other markets in that it'southward driven past supply and need. Using a very basic example, if there is a stiff need for the US Dollar from European citizens belongings Euros, they volition exchange their Euros into Dollars. The value of the United states Dollar will rise while the value of the Euro will autumn. Keep in heed that this transaction merely affects the EUR/USD currency pair and will not for example, cause the USD to depreciate against the Japanese Yen.

Forex Trading: What Drives the Flows?

In reality, the to a higher place example is only one of many factors that can motility the FX market. Others include broad macro-economic events similar the election of a new president, or country specific factors such as the prevailing interest rate, GDP, unemployment, inflation and the debt to GDP ratio, to proper noun a few. Elevation traders make utilise of an economic agenda to stay up to engagement with these and other of import economic releases that can move the market.

On a longer-term ground, ane major driver of Forex prices are interest rates from the related economy, as this can have a straight impact of holding a currency either long or brusque.

What Explains the Popularity?

The strange exchange market allows large institutions, governments, retail traders and private individuals to exchange one currency for another and the 'cadre' of the FX market is what's known every bit the interbank market, which is where liquidity providers trade amongst each other.

The benefit of having forex trade between global banks and liquidity providers is that forex tin be traded around the clock (during the week). As the trading session in Asia comes to a close, the European and Uk banks come online before handing over to the US. The full trading day ends when the US session leads into the Asian session for the following day.

What makes this market even more attractive to traders is The around-the-clock liquidity that is often bachelor. This means that traders can hands enter and exit positions as there are many willing buyers and sellers for foreign exchange.

FOREX TRADING: HOW DOES Information technology WORK?

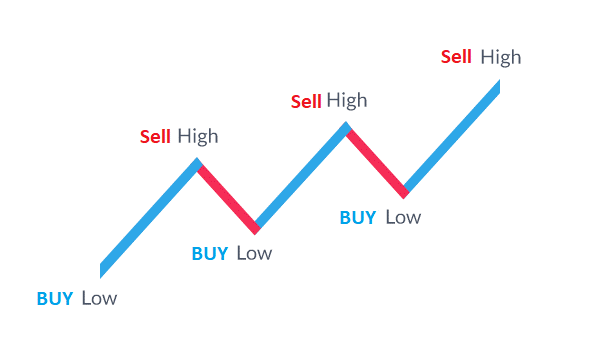

This is very similar to other markets: If you think the value of a currency is going to get up (appreciate), you can wait to purchase the currency. This is known as going "long". If you feel the currency is going to go downwardly (depreciate), you lot sell that currency. This is known as going "curt".

Forex Trading: Who are the Major Players?

At that place are essentially ii types of traders in the foreign exchange marketplace: hedgers and speculators. Hedgers are ever looking to avert extreme movements in the exchange rate. Call back of large conglomerates similar Exxon and how they look to reduce their exposure to foreign currency movements.

Speculators, on the other paw, are risk seeking and e'er looking for volatility in commutation rates to take advantage of. These include large trading desks at the large banks and retail traders.

Reading a Forex Quote

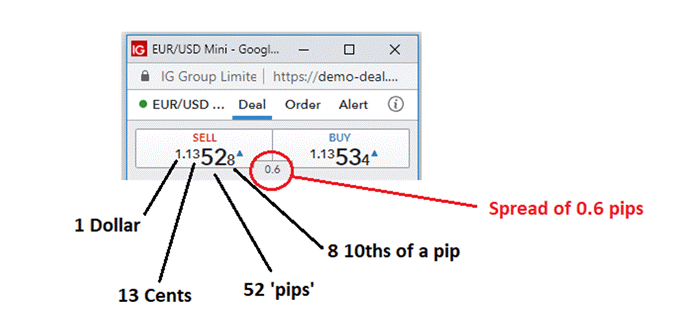

All traders need to understand how to read a forex quote as this is volition make up one's mind the price yous enter and exit the trade. Looking at the currency quote below, the first currency in the EUR/USD pair is known equally the base currency, which is the Euro, while the second currency in this pair (the USD) is known equally the variable or quote currency.

For near FX markets, prices are offered up to five decimals but the first four are the most important. The number to the left of the decimal point indicates one unit of measurement of the counter currency, in this example, it is the USD and therefore is $1. The post-obit ii digits are the cents, so in this case 13 US cents. The third and fourth digits represent fractions of a cent and are referred to every bit pips.

It'due south key to annotation that the number in the fourth decimal place is known as a 'pip'. Should the EUR depreciate against the USD by 100 pips, the new sell price volition reflect the lower price of ane.12528 every bit information technology will cost less in USD to purchase 1 Euro.

Another mode of maxim the above quoted bid price is: The value of I Euro, in terms of US Dollars, is One Dollar, thirteen cents, 52 pips and 8/10th'south of a pip.

To learn more about reading Forex quotes, delight bank check out our article, 'How to Read Currency Pairs: Forex Quotes Explained.'

What is a 'Pip'?

Pip stands for 'percentage in point,' and this is the base unit in a currency pair. The value of a pip volition differ based on the counter-currency in the pairing. For currency pairs in which USD is the counter-currency, or listed second in the quote, the pip value or price will oft be $1 for a 10k lot of currency, which would too mean a pip value or cost of 10 cents for a 1k lot and $x.00 for a 100k lot.

So, if an investor buys a 1k lot of EUR/USD, each pip gained or lost would be worth 10 cents. If the same investor buys a 10k lot of EUR/USD, each pip gained or lost would be worth $ane/each. And if the investor buys a 100k lot, the pip value would exist $10/per.

Running with this example: Let's say that the investor that bought EUR/USD saw a 50 pip gain. Well, if the investor was using a 1k lot, that 50 pip proceeds would amount to $five ($.10 X 50 = 5.00); and an investor using a 10k lot would take a gain of $50 ($1 x 50 = $fifty). And if the same investor was working with a 100k lot, that gain would be $500 ($10.00 10 50 = $500).

Pip toll or value are extremely important data points for forex traders to be aware of, as this is how spreads are communicated; then its very important for traders to 'know their pips.'

To acquire more about pips in Forex, be sure to cheque out our article 'What is a Pip? Using Pips in Forex Trading.'

Forex Trading on Demo Accounts: Gaining Experience without Risking Hard Uppercase

One of the biggest risks or drawbacks of learning a marketplace or learning to trade is the fact that trading tin exist a plush effort, and the adventure of fiscal loss is ever-present when trading bodily hard uppercase on a trading platform. Whenever one buys or sells a Forex pair, they bear the hazard of losing money, and for a new trader that'south just learning their ways, this can exist an expensive tuition.

But many Forex brokers offer demo accounts so that new traders or prospective customers can familiarize themselves with the market, the platform, and the dynamics of forex trading before ever depositing a Dollar, Euro or Pound of their ain money.

The demo account can offer a faux surround where a new trader can implement their strategies and manage their trades with fictional uppercase. This can be an ideal expanse to learn the dynamics of forex trading – how to trigger positions, how to set stops and how to scale out of trades.

Forex Trading: WHY TRADE FOREX?

Trading forex has many advantages over other markets as explained below:

- Low transaction costs: Typically, forex brokers make their money on the spread provided the trade is opened and closed earlier any overnight funding charges are practical. Therefore, forex trading is cost effective when weighed up against a market similar equities, which attracts a commission accuse.

- Low spreads: Bid/Inquire spreads are extremely low for major FX pairs due to their liquidity. When trading, the spread is the initial hurdle that needs to be overcome when the market moves in your favor. Whatever additional pips that move in your favor is pure turn a profit.

- More opportunities to profit: Forex trading allows traders to take speculative positions on currencies going up (appreciating) and going downwards (depreciating). Furthermore, at that place are many different forex pairs for traders to spot assisting trades.

- Leverage trading: Trading forex involves the utilise of leverage. This ways that a trader need non pay the full price of the trade but instead only put down a fraction of the cost. This has the potential to magnify your profits just besides your losses. At DailyFX we suggest a disciplined approach to risk management by restricting your effective leverage to 10 to 1 or less.

New to forex trading? We have a comprehensive guide designed with you in mind to learn the basics of trading.

KEY FOREX TRADING TERMS TO TAKEAWAY

Base of operations currency: This is the first currency that appears when quoting a currency pair. Looking at EUR/USD, the Euro is the base currency.

Variable/quote currency: This is the 2nd currency in the quoted currency pair and is the US Dollar in the EUR/USD example.

Bid: The bid price is the highest cost that a buyer (bidder) is prepared to pay. When you are looking to sell a forex pair this is the price you will come across, usually to the left of the quote and is frequently in cherry-red.

Ask: This is the opposite of the bid and represents the lowest price a seller is willing to take. When you are looking to buy a currency pair, this is the price y'all will meet and is usually to the correct and in blue.

Spread: This is the difference between the bid and the enquire toll which represents the actual spread in the underlying forex market plus the additional spread added by the broker.

Pips/points: A pip or signal refers to a one digit move in the quaternary decimal place. This is ofttimes how traders refer to movements in a currency pair, i.eastward. GBP/USD rallied 100 points today.

Leverage: Leverage allows traders to trade positions while merely putting up a fraction of the total value of the trade. This allows traders to command larger positions with a modest corporeality of uppercase. Leverage amplifies gains AND losses.

Margin: This is the amount of money needed to open a leveraged position and is the difference betwixt the full value of your position and the funds being lent to you lot by the broker.

Margin telephone call:When the total capital deposited, plus or minus any profits or losses, dips below a specified level (margin requirement).

Liquidity: A currency pair is considered to be liquid if information technology can hands be bought and sold due to there being many participants trading the currency pair.

FREE Resource AND GUIDES TO Larn FOREX TRADING

- If y'all are merely starting out on your trading journeying it is essential to understand the basics of forex trading in our gratis new to forex trading guide.

- Nosotros likewise offering a range of trading guides to supplement your forex noesis and strategy development.

- Our research team analyzed over 30 million live trades to uncover the traits of successful traders. Incorporate these traits to requite yourself an edge in the markets.

- Traders frequently wait to retail client sentiment when trading popular FX markets. DailyFX provides such data, based on IG client sentiment

- The forex market has evolved over centuries. For a summarized account of the most important developments shaping this $v trillion a solar day market place read our history of forex commodity.

Forex Trading FAQ

What is Forex Trading?

Forex trading is the act of exchanging i currency for another. The mode in which currency prices are quoted lends itself to trading potential, every bit each currency is quoted in terms of other currencies. The Euro tin be quoted confronting the U.s.a. Dollar (EUR/USD), the British Pound (EUR/GBP), the Japanese Yen (EUR/JPY) amongst a number of other currencies for a long list of EUR-pairings available to traders.

Why do people trade Forex?

The most mutual answer here would be that many merchandise Forex with the goal of gaining profits, by ownership a currency 'low' and so selling 'high,' or vice versa with curt positions in which the goal would exist to 'sell high' and 'cover lower.'

Only this doesn't explain the goals of all Forex traders, as many 'hedgers' or institutions are but looking to alleviate run a risk against adverse currency movements against their positions or investments. An example of this could be an international company similar Toyota, looking to remove or hedge a portion of their exposure in the Yen. Otherwise, if Toyota was entirely invested in the Yen through their capital reserves, and the Yen weakened in value, Toyota's primary business organization could exist vulnerable to the currency losses in the portfolio; and this is a run a risk that can be addressed through diversifying or hedging their currency position.

How does someone get started in Forex trading?

A skillful first footstep would exist to familiarize oneself with the dynamics of the market through a demo account, which tin let a new trader to accept on positions and manage their exposure with fictional dollars in a simulated environment. The demo account can allow the prospective Forex trader the opportunity to trade in a false environment without the chance of financial loss. This can be an ideal training basis for a new trader to learn the dynamics of Forex trading, while building their strategies and getting a better idea for how they want to approach the market place for themselves.

What is the 'all-time' style to go about Forex Trading?

At that place isn't ane universally lauded strategy that traders can comprise that's caput and shoulders above the rest. For about FX traders, the key is finding what works for them, and that'southward frequently based on their own personalities or world views. Probably one of the nearly apt statements regarding this question is that there's not just one way to go virtually trading Forex: At that place are short-term traders that follow their positions on 5 minute charts and there are long-term traders that may not expect at prices but once a solar day.

If yous're trying to get a better idea of what may fit for y'all, the DailyFX DNA FX quiz can assistance: It's a 14 question personality test designed to give y'all an idea of what the optimal arroyo may be for someone of a like personality blazon. Yous tin click the link below to begin the quiz, afterwards which you'll exist supplied with your 'trader blazon' based on the answers you had provided.

Take the DNA FX Quiz

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Source: https://www.dailyfx.com/education/beginner/what-is-forex.html

Posted by: mejiahapse2000.blogspot.com

0 Response to "What Is Forex Trading In South Africa"

Post a Comment