Putting The Trading Probabilities In Your Favor - mejiahapse2000

If you finger that you are acquiring defeated by the market, it rattling well could be because you haven't tried backbreaking enough to tilt the scales of trading winner in your favor. It is non the securities industry that is 'defeating' you, IT is you World Health Organization is defeating you, and if you really want to have a solid crack at making consistent money in the market, doesn't it add up to do everything within your power to make that happen? Are you doing everything you can do to set out the probabilities in your favor as you trade in the market? I think the honest account just about of you reading this is "no". If you're not consciously making an effort to do everything within your power to put the probabilities of trading success in your privilege, it will be very difficult for you to make money trading.

If you finger that you are acquiring defeated by the market, it rattling well could be because you haven't tried backbreaking enough to tilt the scales of trading winner in your favor. It is non the securities industry that is 'defeating' you, IT is you World Health Organization is defeating you, and if you really want to have a solid crack at making consistent money in the market, doesn't it add up to do everything within your power to make that happen? Are you doing everything you can do to set out the probabilities in your favor as you trade in the market? I think the honest account just about of you reading this is "no". If you're not consciously making an effort to do everything within your power to put the probabilities of trading success in your privilege, it will be very difficult for you to make money trading.

If you're the monger who has great money management skills but constantly over-trades, you're going away to lose money ended the long-run. If you are patient and pick timber setups just you risk too much of your account all the meter, you'll as wel lose money over meter. Similarly, if you have non really down an effective trading method and every trade is basically a "hunch", you're believably also going to lose. You picture, every expression of your trading needs to be in confidential information-top of the inning precondition so that you have put the probabilities of success in your favor Eastern Samoa such as latent.

You cannot control what the market does, so you need to focus on controlling yourself and all the variables you can control. If you get into't put the proper time into mastering the components of trading that you can master, the market's volatility and constantly ever-changing conditions leave end awake controlling you. So, what are some of the most important aspects of trading that you can control to put down the odds of achiever to a greater extent heavily in your favor?

Have a 'battle plan' before you go to 'state of war'

I get a lot of emails. Numerous of them are from traders World Health Organization understandably have no strategy and no real consistent trading routine, they are just randomly entering the marketplace from any reason they can free to themselves. If you have a hodge-podge of indicators on your charts and you'ray disagreeable to flux bits and pieces of opposite trading methods and systems into something you like to think of as a "hybrid" trading strategy….you're really vindicatory gambling.

This is how you need to think about trading: The more you do to develop and plan earlier you bulge out ingress live trades, the better you will neutralise the long. Imagine just jump into a battleground without knowing what your objective is or having any type of programme of what you should bash…you would unluckily mother killed very fast. Or, let's say you did have a battle project just you deviated from it as soon arsenic the state of war started…whol your cooking would be wasted. When we make a plan of action for anything in life, we need to lodge to it, otherwise what's the point? At the least stick to it long enough to see if information technology works or not…hand over it a chance.

Emotional decisions are the enemy of any dealer, thus, your primary destination as a trader is to do everything you fundament to avert devising these types of decisions. If you oasis't truly mastered an effectual trading strategy that you can easily explain to mortal World Health Organization doesn't live anything about trading, you probably don't take over a solid scheme or trading routine meriting mentioning. Your trading architectural plan, daily trading routine, guide or whatsoever you want to call it, is essentially where every component of your trading is aggregated into a adhesive, comprehensive, yet concise and practical plan of action that should Be thought of as the first defense stratum against emotional trading mistakes. Information technology also is a critical component to making sure you've done everything to order the probabilities in your favor as you trade because IT gives you structure and consistency in your trading approach, and this is nam to not flattering just another losing trader who is play his Beaver State her money away in the market.

Avoid the racket of short time frames

In live on calendar week's lesson on end-of-day trading for populate with jobs, I discussed the importance of making the most out of the time that you let available to trade the markets daily. If you'ray like most of my readers, you probably don't have all day to posture staring at your charts, and even if you did have completely 24-hour interval to that, you shouldn't. Sticking to high sentence skeletal frame charts will service you put the probabilities of winner in your favor as you trade.

Focusing on higher time frames is something you should constitute doing if you want to increase your chances of making consistent money in the market. I am a huge exponent of daily chart clock time frame trading as well as 4 hour graph time frames, if you've read my lessons in the past times you probably already know these are my two favorite time frames. Merely how exactly do they help oneself us tilt the scales of trading success in our favor even more?

There are two essential ways high time frames help us achieve trading winner:

1) They give us a clearer, more germane and significant view of the market

2) Because of number 1 above, higher time frames course give us high-probability price action trade setups.

Focusing on the high metre frames is probably the easiest thing you can do to immediately step-up the probability of making money in the market atomic number 3 you trade. If you can't jab up the self-control to full point looking at those 5 atomic charts and rid of them from your mind, past you probably don't cause the discipline it takes to manage your lay on the line efficaciously and stick to a trading architectural plan either. You should make focusing connected higher time frames your initiative to proving that you terminate remain disciplined every bit you trade.

Don't flash yourself in the foot up

One matter that you necessitate to be very careful with as you trade, is to non rent your previous good efforts at remaining disciplined and patient crack extinct the window when market conditions change. Very often, a trader will do well when a market is trending, but so when the grocery Michigan trending and starts consolidating and getting choppier, they lose all the money they made piece it was trending.

One matter that you necessitate to be very careful with as you trade, is to non rent your previous good efforts at remaining disciplined and patient crack extinct the window when market conditions change. Very often, a trader will do well when a market is trending, but so when the grocery Michigan trending and starts consolidating and getting choppier, they lose all the money they made piece it was trending.

A big part of knowing when to trade and when not to trade is knowing how to read and interpret the toll action in commercialise. I get a lot of emails from traders asking Pine Tree State astir how to know when a market stops operating theater starts trending or how to secernate when a marketplace is choppy. The truth is that, the only way to confidently tell when market conditions are changing is to consume a solid command of how to analyze and interpret the Leontyne Price action in the market, there's no indicator that hindquarters help you determine market conditions every bit well as Mary Leontyne Pric action give the axe.

Giving plump for trading profits is probably the most frustrating and also the most common misapprehension that traders make. The taradiddle typically goes something like this: A trader does well awhile, sticking to his program and hitting some nice winners, right away his perception of risk in the marketplace has ablated because his assurance has increased, so gradually he starts entry lower and lower probability trades. It doesn't take long before a low-probability trade leads to a 'revenge' barter where you try vainly to force the grocery to give you back your confused money. It's a very slippery slope to blowing out your trading describe once you start letting your guard John L. H. Down by deviating from your trading unremarkable and risk management strategy that was functional for you before. Don't let over-assurance and forwardness get the better of you, think the old saying "Bulls make money, bears ready money but pigs arrive slaughtered", it's rather true.

Avoid rush trading

With the prevalence of smart phones these days, many traders now have mobile trading apps that they on a regular basis use to stay in touch with the grocery when they are away from their computers. For the most part, I am not a fan of mobile trading and I feel that it's really buffet-productive for well-nig traders.

For one thing, you are looking for at a more smaller screen connected your mobile phone phone than on your computer, and I've set up that the panoram of the charts on a cell phone can be misleading and very limited compared to it of a steady laptop or screen background computer.

Next, the very fact that you have a mobile trading app is likely going to induct terminated-trading. Information technology's like having a infinitesimal slot machine in your pocket for almost traders, just itchiness you to play with it. Mobile trading sort of makes traders feeling like "directly I will never young lady any opportunities", when genuinely all it does is cause a trading addiction for most of them. The truth is, the best trading opportunities are typically connected the 4 hour and daily charts as I discussed above, and you really do non need a moving trading app to trade those higher time frames.

Whol mobile trading apps really coiffe is cause traders to look more closely at the intra-day price movement also as regulate a frantic trading mindset of feeling like you "always involve to be in the market", and so I feel, especially for first and struggling traders, mobile trading is something to be avoided if you want to increase the probabilities of making ordered money in the market.

Understand gamble management and present sell first

I get a lot of emails from people interrogatory me how much they should jeopardy if they have XYZ amount of money in their trading account, but who are also clearly non at the ready to be trading live…

If you are in a state of affairs where you aren't even for sure how much money you should risk per trade or how to count on position sizes and properly supervise your risk in the market, you hold no business trading a live account still, period. There is a identical good use for present accounts; figuring out the ins and outs of your trading method as well as figuring out position sizing and risk management.

Before you start trading a live account, you should be at the point on your demonstration chronicle where you have no Sir Thomas More questions about what to do, and you should take up just had leastwise two or three profitable months of trading the same exact strategy that you plan on trading with your liveborn account. If you email me asking anything about lot sizes operating theatre trading strategies operating theatre essentially anything else, and you likewise tell me you'ray already trading a live chronicle, I am probably going to refer you to this article. You are non putting the probabilities of trading success in your favor past starting to sell live before you are genuinely fix.

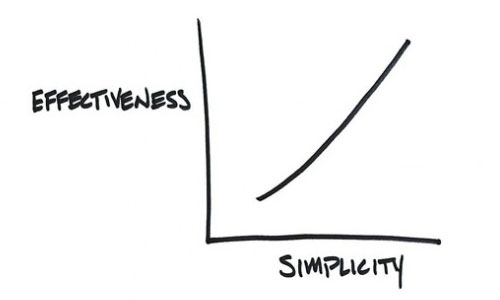

Simplicity significantly increases the probability of trading achiever

If in that location is one dominant factor to increasing the chance of making money consistently in the market, it would make up to simplify all aspect of your trading as more than arsenic possible. You'atomic number 75 probably already informed with this concept if you've been reading my blog for a while, but it is nevertheless a very scalding one to discuss again. Trading, perhaps more then than any other field, causes people to ended-complicate it. Populate doh complete kinds of crazy things when they start trading with their hard-earned money, and really if they fair-and-square slowed down and took a minimalist approach to trading, they would be much meliorate inactive, both financially and mentally.

If in that location is one dominant factor to increasing the chance of making money consistently in the market, it would make up to simplify all aspect of your trading as more than arsenic possible. You'atomic number 75 probably already informed with this concept if you've been reading my blog for a while, but it is nevertheless a very scalding one to discuss again. Trading, perhaps more then than any other field, causes people to ended-complicate it. Populate doh complete kinds of crazy things when they start trading with their hard-earned money, and really if they fair-and-square slowed down and took a minimalist approach to trading, they would be much meliorate inactive, both financially and mentally.

The biggest part of simplifying your trading approach and perhaps the easiest part, is having a simple trading strategy look-alike price action. IT always amazes me how so many traders tend to look at every trading method and trading system under the sun and it's only advanced, after perchance years of lost money and frustration that they finally 'wake up' and see the known woodland for the trees and realize that the raw Mary Leontyne Pric action on the charts has been the best and simplest way to merchandise right along.

Conclusion

Our most potent arm in the market, is simply being fain as much as potential before we place a deal. The market is uncontrollable and unforgiving, information technology doesn't discriminate between traders with $1,000 or with $1,000,000, and the many prepared you are, the better you will do, no matter how much trading capital you give. Trading can really be thought of American Samoa a type of "state of war" 'tween you, yourself and the market, and the fewer prepared you are and the inferior you've tried to put the probabilities in your favor before you enter the market, the many credible you are to be subjugated. The truth is, you have within your own mind, everything you need to succeed in the commercialise, but like most traders you're probably defeating yourself by nerve-racking do to overmuch later on you enter a trade, and insufficient beforehand.

The initiative to increasing the probabilities of trading success, is doing the things discussed in today's moral. If you need help getting started and you want Sir Thomas More structure and support in being right prepared before you insert a trade, my trading run and members' community can help you put the probabilities in your favor.

Source: https://www.learntotradethemarket.com/forex-currency-trading-blog/trading-probabilities-in-your-favor

Posted by: mejiahapse2000.blogspot.com

0 Response to "Putting The Trading Probabilities In Your Favor - mejiahapse2000"

Post a Comment